Gold, silver and platinum stored at The Safe House serves as a reliable store of value independent of financial systems, offers protection against inflation and currency devaluation, and provides legal title ownership of tangible assets under exclusive Singapore jurisdiction.

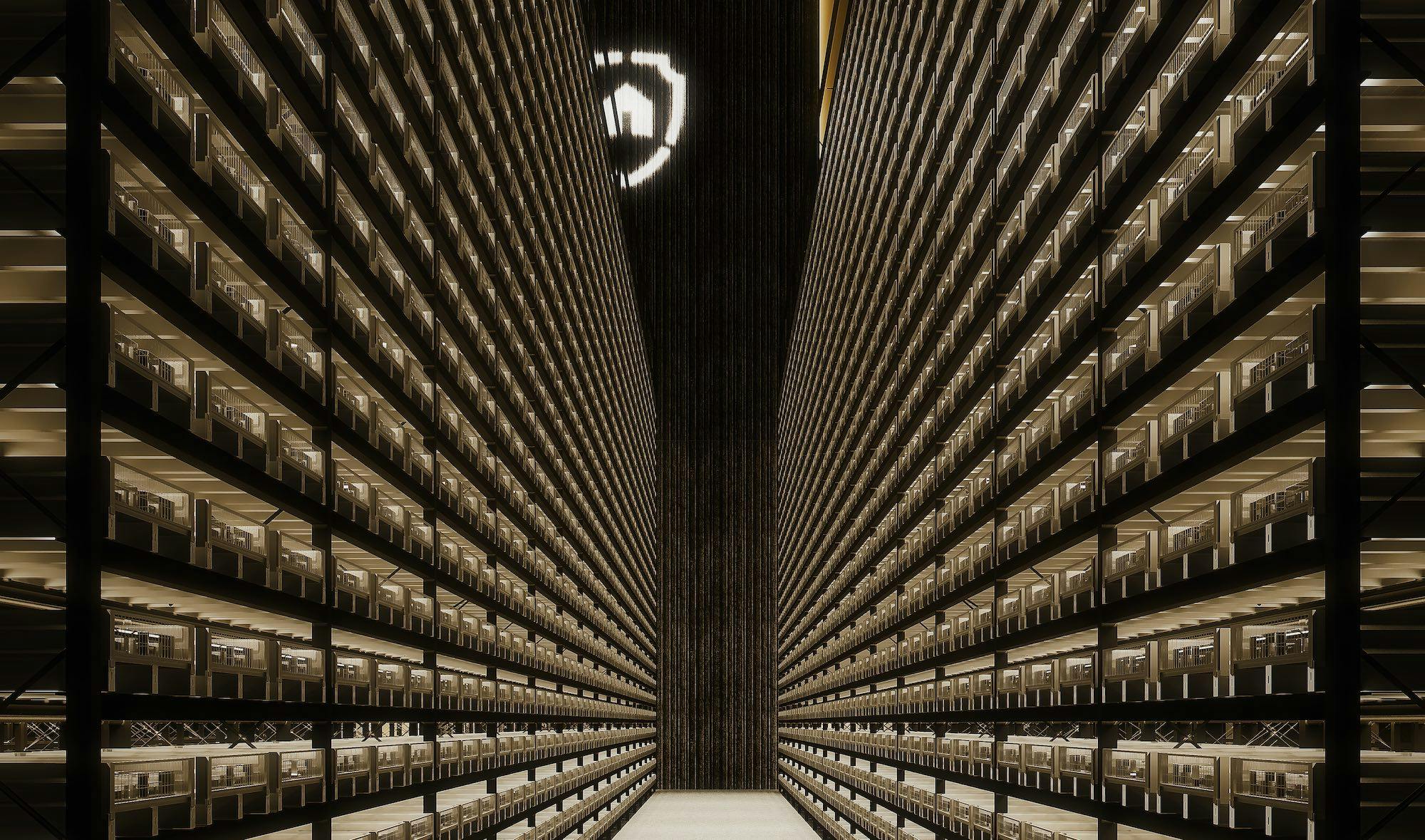

Capable of securely storing over 30% of global annual silver supplies and hosting fifteen UL rated Class 2 gold vaults, The Safe House can store strategic quantities of precious metals as well as rare industrial metals in a geopolitically neutral jurisdiction without material foreign dependencies.

INSTITUTIONAL DIRECT STORAGE

Industry-Leading Vaulting Services

Our high-capacity storage solutions track your bullion by their unique serial number or parcelized in tamper evident and uniquely identifiable parcel bags. These parcels are kept in customized metal enclosures for auditing and are stored under exclusive Singapore jurisdiction.

You can transfer existing bullion to us or purchase precious metals through our parent company. Institutional direct storage accounts start with 4 million USD minimums and we provide:

- ISO 9001 certified segregation, tracking and ownership by bar/parcel

- Offline networks for uncompromised data security

- Optional GramChain Tracking for tamper evident realtime parcel tracking

- Optional reporting by sub-accounts (omnibus)

- Optional testing and genuinity guarantee of transferred-in bullion

- Comprehensive insurance (incl. mysterious disappearance)

- Tax-free/bonded storage

- Annual, quarterly and/or on-demand audits

For non-institutional accounts consider opening a S.T.A.R. Storage account with our parent company.

Personal Vault Safe Deposit Boxes

Privacy Without Compromise

Safe deposit boxes are designed for clients who desire the privacy of storing items themselves. Once secured with tamper evident seals, the client and his authorized representatives have sole access control of the box.

Locked and sealed in the presence of the client it limits the relationship with The Safe House to that of a rentor and box hirer. It is possible for The Safe House to initially fill a box on a remote basis for a client and provide video footage of the process. Subsequent access to the box would have to be made by the client or representative.

Our Class I boxes are among the largest in the world and ideal for bulky assets such as silver, boasting a 202 kg capacity. The Class II boxes are designed for gold and platinum and can be insured for the full value of the content.

- Segregated Class I and II box storage

- Offline networks for uncompromised data security

- Sole Singapore jurisdiction

- Up to 4 authorized representatives

- Optional remote provision of box (silver for class I, gold, platinum for class II boxes)

- Optional comprehensive insurance (incl. mysterious disappearance)

For remote box provisioning precious metals can be procured via our parent company.

Download our Safe Deposit Box Product Brochure with detailed specifications and pricing.

Private Vault Safes

High-capacity safes within ULCL2 gold vaults

Protected within one of the fifteen United Laboratories Class II rated modular vaults, private safes enable very low insurance premiums, providing sizable gold storage capacities at comparatively low costs.

Developed specifically for high-net-worth clients, family offices and wealth management companies, these private safes are well suited for inter-generational wealth preservation, the stored assets being independent of financial systems and offering protection against inflation and geopolitical turmoil.

Private safes can be operated on a segregated basis, whereby deposits and withdrawals can be requested remotely, or on a dual access basis, requiring a client representative to be physically present before the safe can be accessed.

- Private gold safes with capacities of up to 300, 500 and 1,000 kg

- Includes comprehensive insurance coverage

- Vault safe access can be customized based on client requirements

- Offline networks for uncompromised data security

- Exclusive Singapore jurisdiction

Serviced Vault Safes

Institutional gold vault leases

Serviced UL Class II gold vault leases offer a complete turn-key vaulting solution designed to meet the stringent requirements of institutional clients at competitive costs. Leased vaults can be white labelled to provide a foundation for a physical gold storage program and become a strong USP to the institution’s clients interested in gold storage.

Each vault can securely store around 22,000 kilograms, being over 700,000 troy ounces of gold and providing high capacities and efficiencies of scale. Institutional vault lessors will also receive up to 8 facility access passes, enabling their relationship managers to bring prospective clients to The Reserve’s 5th floor and promote the institution’s gold program.

Private safes can be operated on a segregated basis, whereby deposits and withdrawals can be requested remotely, or on a dual access basis, requiring representatives of the lessor to be physically present before a vault can be accessed.

- ISO 9001 certified segregation, tracking and ownership by bar/parcel

- Offline networks for uncompromised data security

- Optional reporting by sub-accounts (omnibus)

- Optional testing and genuinity guarantee of transferred-in bullion

- Comprehensive insurance (incl. mysterious disappearance)

- Tax-free/bonded storage

- Annual, quarterly and/or on-demand audits

- Vault safe access can be customized based on client requirements

- 8 Relationship Manager passes to utilize The Reserve’s facilities

Precious Metal Testing (DUX)

Providing certainty and liquidity

For a small charge, our testing laboratories on site can verify that the gold, silver and platinum received has not been adulterated and is genuine. This is particularly important if the bullion is not coming directly from a refinery or mint.

Once DUX tested, the bullion can be sold or collateralized, subject to AML requirements, with relative ease. Our testing methodology includes up to 5 separate non-destructive tests as illustrated in this video.

Our DUX testing has been part of the agenda of the 2025 LBMA Assaying & Refining Conference in London where we presented in the company of the heads of analytical laboratories of major refiners such as Hereaus, Metalor, Valcambi and MKS.